Introduction: Unleashing the Potential of ETFs

Table of Contents

Exchange-Traded Funds (ETFs) have become a popular investment vehicle for both beginners and seasoned traders. They offer the diversification benefits of mutual funds while providing the liquidity and real-time pricing of individual stocks. If you are new to the world of ETFs, it is essential to explore the vast potential of these financial instruments and how they can fit into your trading strategy.

In this article from Your first systematic portfolio series, we will dive deep into the concept of rotational trading with uncorrelated ETFs, covering different sectors such as stock indices, properties, and commodities. We will discuss how this approach can help reduce risk and potentially boost returns.

The Art of Rotational Trading

Rotational trading is a strategy that involves periodically switching your investments between different asset classes or sectors. The idea is to capitalize on market cycles and momentum by moving your money into the best-performing assets while limiting exposure to underperforming ones.

Here are the key steps in a typical rotational trading strategy:

- Identify a set of asset classes or sectors to invest in.

- Determine the investment timeframe (weekly, monthly, quarterly, etc.).

- Monitor the performance of the assets and identify the top performers.

- Reallocate your portfolio, shifting funds from underperforming assets to the top performers.

- Repeat the process at the end of each investment timeframe.

The Power of Uncorrelated ETFs

The key to a successful ETFs rotational trading strategy lies in selecting uncorrelated ETFs from different sectors. This allows you to take advantage of diversification and risk reduction, as the performance of one ETF is less likely to impact the others.

Benefits of trading uncorrelated ETFs include:

- Diversification: By investing in uncorrelated assets, you spread your risk across multiple sectors, reducing the overall portfolio volatility.

- Risk reduction: Uncorrelated assets can help mitigate market downturns, as one asset’s underperformance is less likely to drag down the entire portfolio.

- Potential for improved returns: By focusing on the top-performing assets, you can potentially increase your overall returns.

Diverse Sectors, Complementary ETFs

To create a robust rotational trading strategy, consider incorporating ETFs from the following sectors:

- Stock indices: These ETFs track the performance of major market indices, such as the S&P 500, Nasdaq 100, or Russell 2000. Examples include SPY, QQQ, and IWM.

- Properties: Real estate ETFs invest in a diverse range of property assets, from commercial buildings to residential properties. Examples include VNQ and IYR.

- Commodities: Commodity ETFs provide exposure to physical commodities, such as gold, silver, or oil. Examples include GLD, SLV, and USO.

By combining ETFs from these sectors, you can create a well-rounded portfolio with the potential to withstand market fluctuations.

ETF Rotational Trading Strategies in Action

There are several ETF rotational trading strategies that can help you maximize returns and minimize risk. Here are two examples:

- Momentum-based strategy: This approach involves identifying the top-performing ETFs in your chosen sectors and allocating a larger portion of your portfolio to these assets. By riding the momentum of the best performers, you can potentially increase returns.

- Relative strength strategy: This method focuses on comparing the performance of different ETFs within a specific sector. Allocate funds to the ETFs with the strongest relative performance, providing exposure to the best-performing assets within each sector.

The Numbers Speak: Case Studies and Data

To demonstrate the potential benefits of incorporating uncorrelated ETFs in rotational trading strategies, let’s examine some case studies and data:

- A study by Meb Faber compared the performance of a traditional buy-and-hold strategy with a simple ETF rotational trading strategy using the S&P 500, 10-Year US Treasury Bonds, and Gold. Over the 40-year period from 1973 to 2013, the rotational strategy delivered an annualized return of 12.1%, while the buy-and-hold strategy yielded only 9.5%. Moreover, the rotational strategy experienced lower drawdowns and volatility.

- An analysis by Gary Antonacci found that a dual-momentum rotational strategy, which combined both relative strength and absolute momentum, significantly outperformed a buy-and-hold strategy from 1974 to 2013. The dual-momentum strategy produced an annualized return of 17.4% with a maximum drawdown of 19.7%, compared to a 10.4% return and 50.9% drawdown for the buy-and-hold strategy.

These case studies highlight the potential for improved returns and risk reduction when incorporating uncorrelated ETFs in rotational trading strategies.

Implementation of ETFs rotational strategy

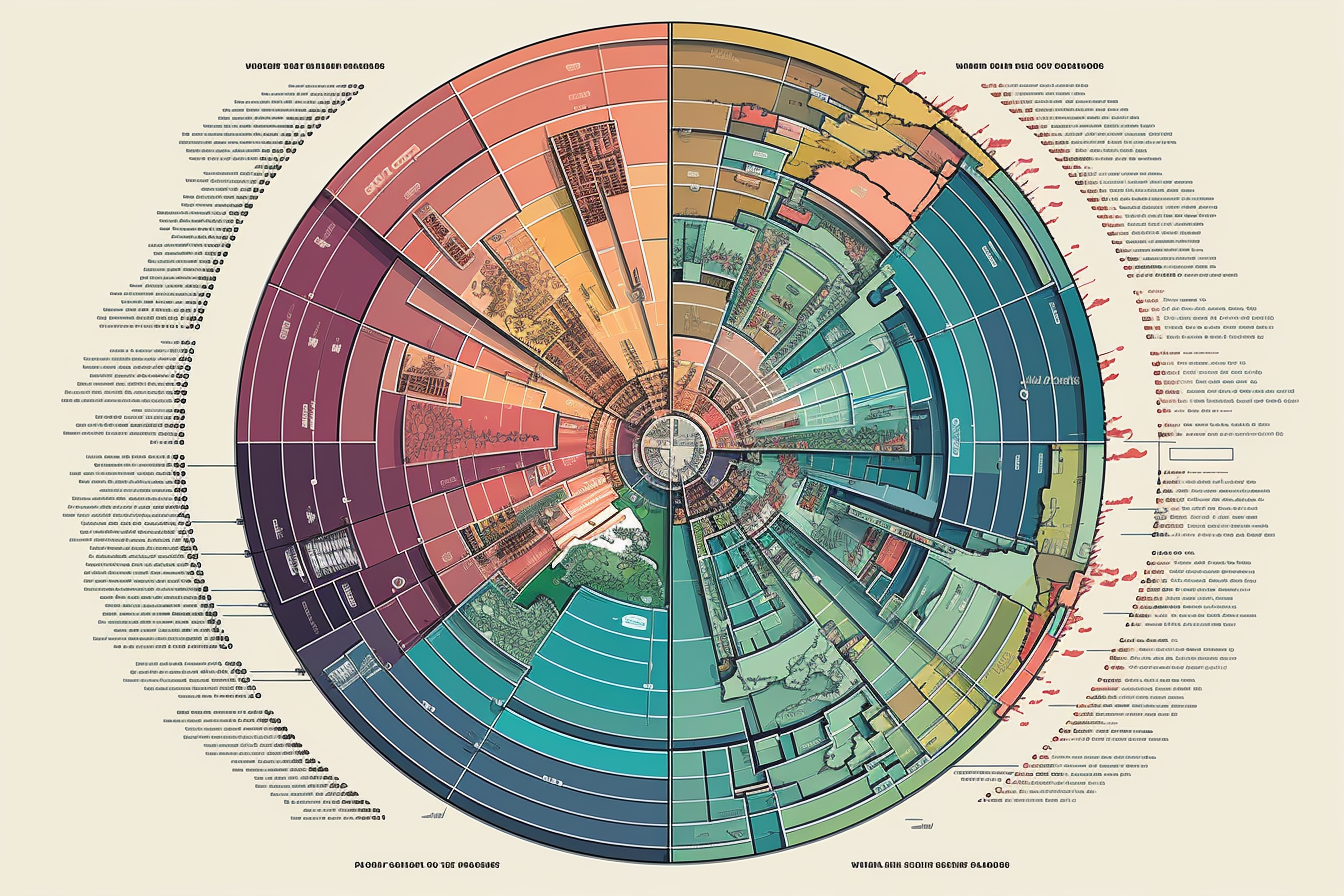

I have developed strategy called One and Only according to steps described in chapter: The Art of Rotational Trading. Ive measured correlations of approximately 20+ ETFs from different asset classes, sectors and regions and choose 6 with the least correlation to create universe for One and Only strategy.

Strategy rebalances on monthly basis and holds only one ETF at a time (thats why it is called One an Only). ETF to hold is chosen with very simple position scoring measuring its past momentum and volatility. Despite its extreme simplicity, strategy have quite good results, as you can see on following images, from 1.1.2015 to 31.12.2022 strategy had annualized return of 17.16% with maximum drawdown of 33%.

Given that such strategies are not that hard to create and implement I can only suggest to create some backtests on given idea and when ready, add it to your portfolio. Benefits of such strategy, as already stated is its simplicity, diversification already incorporated in main idea behind the strategy (and yes, feel free to combine ETFs from whatever asset class you like), and of course it is easy to trade (even manually given its mohtly rebalancing period) with quite low transaction costs.

So lets get to work! Make the strategy systematic to trade it in your portfolio – as it is the only holy grail in trading!

Conclusion on trading uncorrelated ETFs

In conclusion, incorporating uncorrelated ETFs from different sectors in a rotational trading strategy can potentially boost returns and reduce risk for beginning and intermediate-level traders. By understanding the benefits of diversification, selecting complementary assets, and developing a sound trading approach, you can position yourself for long-term success in the world of ETF investing.

- The Power of Quantified Trading Portfolios: A Guide for Beginners

- An Introduction to Rotational Trading Strategies for Beginners

- Comparing Your Trading Strategy Performance to Benchmarks: A Guide for Unexperienced Traders

- Supercharge Your Trading Portfolio with Momentum Pullback Strategies

- The Power of Uncorrelated ETFs in Rotational Trading Strategies: Boosting Returns and Reducing Risk

- Triple Threat: Construct Your First Systematic Portfolio Using Three Uncorrelated Trading Strategies