Introduction: Unleash the Power of Combined Strategies for Retail Traders

Table of Contents

Are you a retail trader looking for ways to increase your portfolio performance while reducing risk? Look no further! In this article from Your First Systematic Trading Portfolio series, we will explore how combining three uncorrelated trading strategies into portfolio affect your returns and risks. As Ive already wrote, trading systematic portfolios is one and only holy grail in trading. Say goodbye to sleepless nights and hello to a new world of trading possibilities.

The three strategies we will delve into are:

- Rotational trading strategy – Smart Nasdaq Momentum

- Pullback momentum strategy – Second Wave

- Rotating uncorrelated ETFs – One and Only

By combining these strategies, you can create a powerful and diversified systematic trading portfolio that outperforms the market and reduces risk. So, let’s dive in and see how these strategies can work together to supercharge your trading experience!

Introducing the Three Trading Strategies

Lets just briefly recapitulate basic ideas behind strategies – Ive alredy covered it in more detail in separate articles. Feel free to skip this chapter if you have already read previous articles about individual strategies.

Smart Nasdaq Momemntum – Rotational Trading Strategy

The rotational trading strategy is a systematic approach to trading that involves periodically rotating your investments between different assets or sectors based on their performance. This strategy helps you capitalize on the market’s constantly changing landscape, allowing you to invest in high-performing assets while avoiding those with poor performance.

Second Wave – Pullback Momentum Strategy

The pullback momentum strategy focuses on identifying strong trending assets that are experiencing short-term pullbacks or retracements. These pullbacks are usually temporary and present an excellent opportunity to enter the market at a better price before the trend resumes. This strategy is particularly useful in volatile markets, where asset prices may experience rapid fluctuations.

One and Only – Rotating Uncorrelated ETFs

Rotating uncorrelated ETFs involves investing in a selection of exchange-traded funds (ETFs) with low correlation to each other. This approach helps to spread risk across different asset classes or sectors, reducing the impact of any single market event on your portfolio. By investing in a diverse range of uncorrelated ETFs, you can achieve better risk-adjusted returns.

Benefits of Combining These Strategies into Systematic Portfolio – Increased Returns and Reduced Risk

When you combine these three trading strategies, you can enjoy the benefits of diversification and reduce the overall risk of your portfolio. This is because each strategy targets different types of assets and market conditions, ensuring that your investments remain balanced and resilient in the face of market turbulence. Moreover, by capitalizing on the strengths of each strategy, you can achieve higher returns than if you were to rely on just one approach.

Backtesting the Combined Portfolio

To demonstrate the improved performance and risk reduction of the combined portfolio, we have conducted a backtesting exercise using historical market data. Our analysis shows that the combined portfolio significantly outperforms each individual strategy, while also exhibiting lower volatility and drawdowns.

Backtested metrics

All backtest was performed on dates from 1.1.2015 to 31.12.2022, IB commissions included, no slippage and without any leverage.

Smart Nasdaq Momentum

Annualized return: 20.91%

Max drawdown: -26.85%

Second Wave

Annualized return: 23.86%

Max drawdown: -22.31%

One and only

Annualized return: 17.54%

Max drawdown: -36.31%

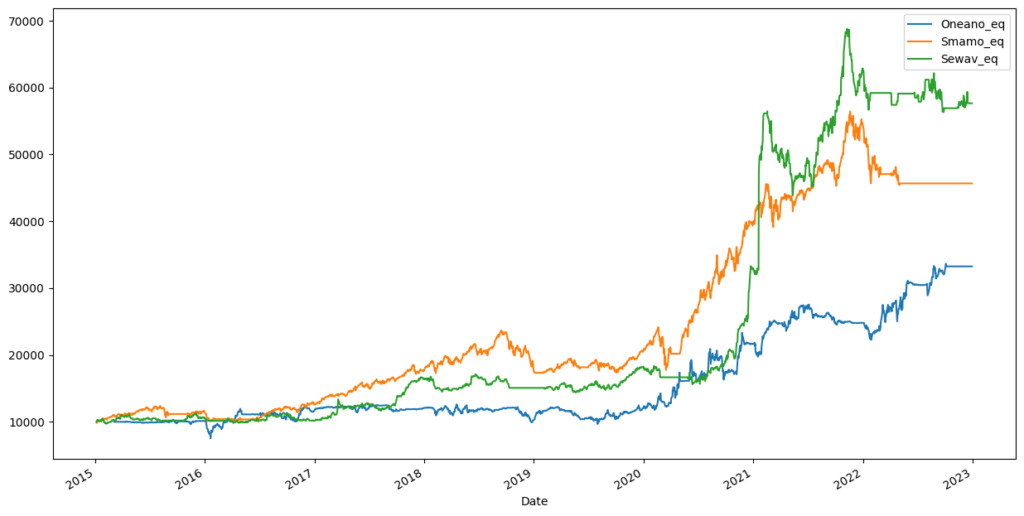

Lets assume you have 10 000$ back in 2015 and you invest whole your money into one of mentioned strategies. We can check comparison of its equity curves on following graph:

As you can see, all of them are profitable and every single strategy have period of significant drawdown – lets just check beginning of 2016 (Oneao), end of 2019 (Smamo), first and last quarter of 2021 (Sewav and Smamo). Relying on single strategy means that sooner or later, you will suffer quite long and significant drawdown you have to go through.

Portfolio: Where the Magic Happens

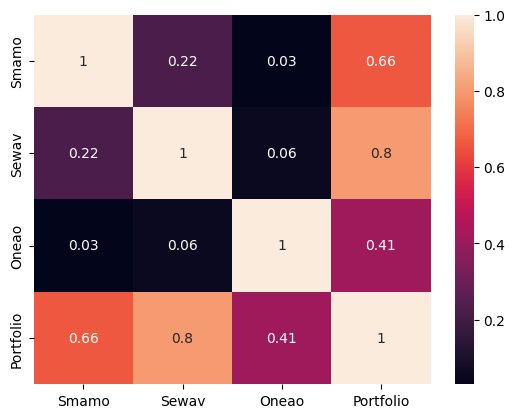

Let’s explore the potential benefits of integrating these strategies into a single, cohesive portfolio. First, we must ensure that the strategies are not correlated, as leveraging uncorrelated profits from various edges and timeframes is crucial for optimizing your equity curve. By reducing volatility, we aim to minimize drawdowns and amplify gains, thus creating a more robust and rewarding investment approach.

Observe the notably low correlations among these strategies, even though they all focus on US Stocks. This paves the way for integrating these strategies into our premier portfolio. The fundamental principle to remember when incorporating a new strategy is to maintain a maximum profit correlation of 0.5 or lower (ideally lower) with existing strategies, ensuring a well-balanced and diversified approach.

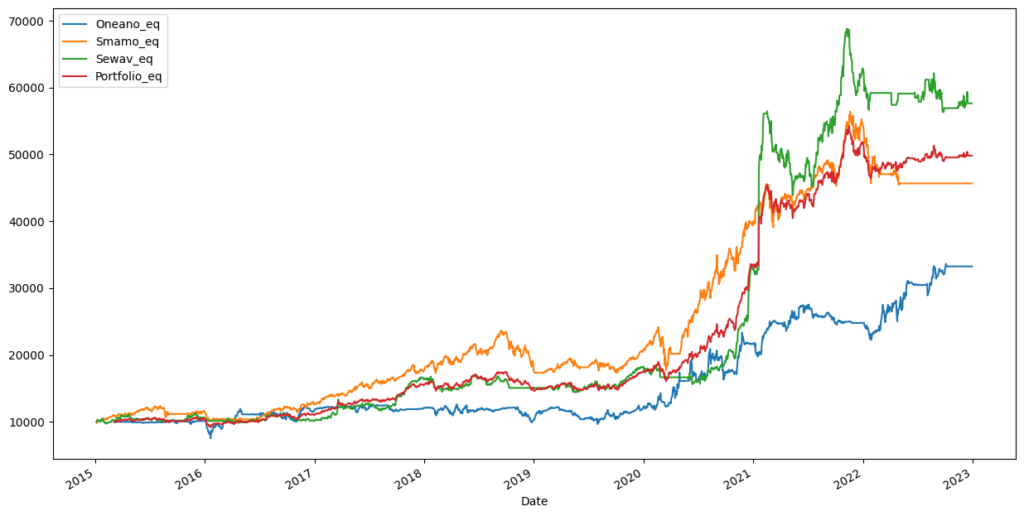

In the earlier chart, the performance of individual strategies was demonstrated, each utilizing 100% of a $10k capital allocation. To build our inaugural portfolio, we will strategically divide the same $10k capital (avoiding leverage) into smaller portions, assigning each segment to a different strategy for a well-rounded investment approach:

- Smart Nasdaq momentum – 40% ($4000)

- Second Wave – 40% ($4000)

- One and Only – 20% ($2000)

This illustration demonstrates one way to allocate capital across various strategies. The beauty of trading within a portfolio lies in your ability to significantly influence both volatility and returns by simply adjusting the weight assigned to each individual strategy. Let’s now examine the performance of this straightforward example portfolio:

The updated chart mirrors the previous one, but now features a red line representing the equity curve of our proposed portfolio. By examining the same points previously highlighted, where individual strategies experienced their most significant drawdowns, it becomes evident that these drawdowns are substantially reduced while still maintaining impressive gains within the context of the portfolio.

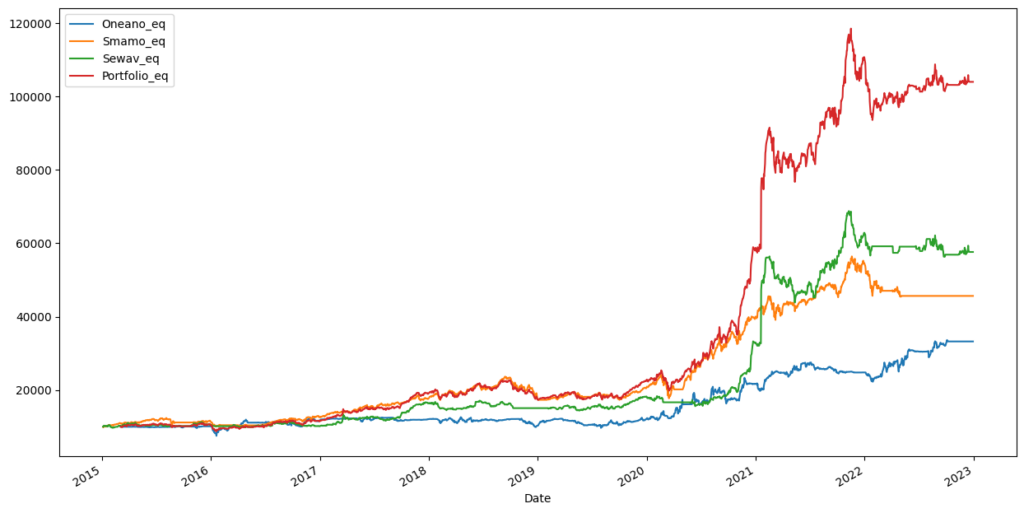

By mitigating risk with lower drawdowns, we can now consider incorporating a modest amount of leverage into our portfolio (Interactive Brokers allows up to 200% of your equity when trading stocks). Keep in mind that this demonstration serves to showcase the advantages of portfolio diversification and is not an endorsement of leveraging in live trading with only three strategies. To ensure minimal risk when enhancing your portfolio with leverage, a more extensive range of strategies is recommended.

Now we construct same portfolio, but we will assing 150% of our capital (use margin):

- Smart Nasdaq momentum – 60% ($4000)

- Second Wave – 60% ($4000)

- One and Only – 30% ($2000)

Experience the impact of minimal leverage – a remarkable transformation! Trading portfolios provide you with incredibly powerful tools to manage risks and enhance returns effectively. By merely combining three exceptionally straightforward strategies, we have achieved a significant difference in performance of average annual return of 33.29%.

One of the remarkable advantages is the ease with which you can begin trading such a portfolio. Rotational strategies require trades only once per month, translating to generating entry and exit signals merely every second day of the month. Utilizing specialized scanners, you can automate entry signals for One and only, Smart Nasdaq Momentum, and even Second Wave before the trading day commences. By dedicating a mere 15 minutes a day, you can actively manage your first trading portfolio!

Portfolio Trading: The First Steps

It does not metter if you are beginner who wants to start trading or you already have your live account, but without satysfying results. With massive benefits it gives, set your first big trading milestone to contruct and start trading first simple portfolio! You can follow this basic guidelines:

- Create 100% systematic rules for 3 simple idea based strategies (feel free to get inspired by previous articles in this series)

- Properly backtest created strategies, verify their robustness

- Ensure they are not correlated too much

- Prepare scanners to generate entry signals for you

- Start trading your first systematic portfolio on demo account

- When your executions are ok and everything works well during your incubation period – GO LIVE!

Conclusion: Boost Your Portfolio Performance with the Power of Three

Incorporating the rotational trading strategy, pullback momentum strategy, and rotating uncorrelated ETFs into your trading arsenal can significantly enhance your portfolio’s performance while reducing risk. By combining these three uncorrelated strategies, retail traders can achieve a diversified and resilient portfolio that navigates market turbulence with ease.

As this is the last article of the series I hope you gained lot of inspiration on where to start and clear goal you want to achieve as your first milestone in trading – build your first systematic portfolio!

So, take advantage of this powerful triple threat and start building your own successful trading portfolio today! And remember, in the world of trading, knowledge is power – so stay informed, stay disciplined, and never stop learning. Happy trading!

- The Power of Quantified Trading Portfolios: A Guide for Beginners

- An Introduction to Rotational Trading Strategies for Beginners

- Comparing Your Trading Strategy Performance to Benchmarks: A Guide for Unexperienced Traders

- Supercharge Your Trading Portfolio with Momentum Pullback Strategies

- The Power of Uncorrelated ETFs in Rotational Trading Strategies: Boosting Returns and Reducing Risk

- Triple Threat: Construct Your First Systematic Portfolio Using Three Uncorrelated Trading Strategies