Unearth the significance of a market edge and comprehend its critical role in crafting strategies anchored in distinctive competitive advantages. Engage with the triad of fundamental market edges: the momentum in US stocks, the dynamism in ETFs, and the momentum pullback observed in US stocks.

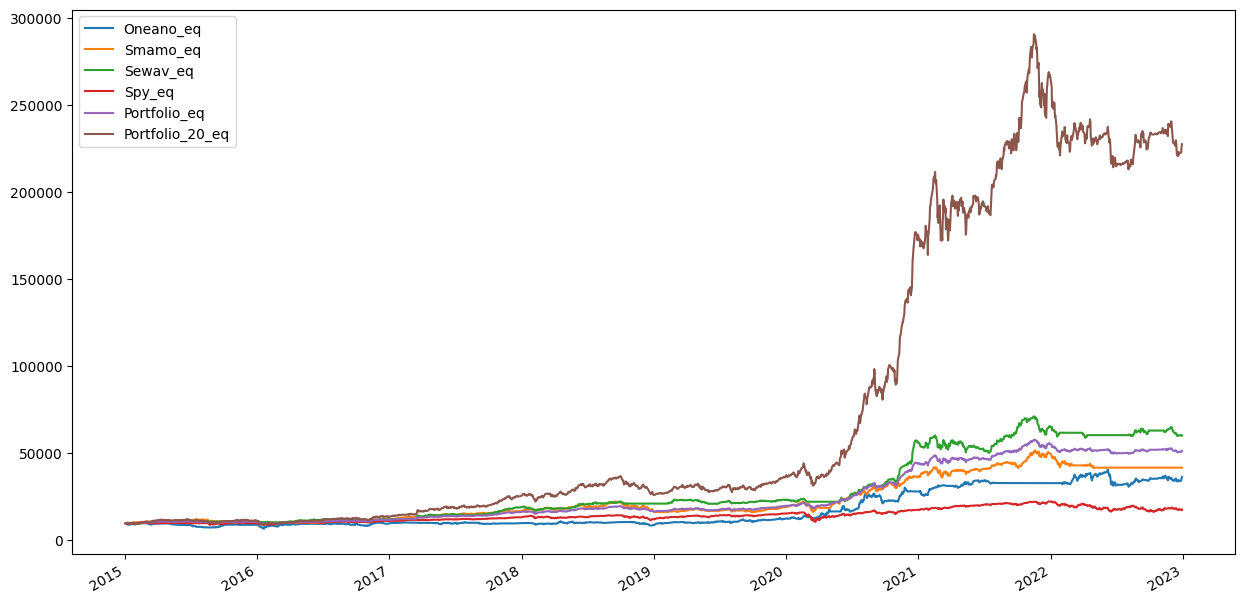

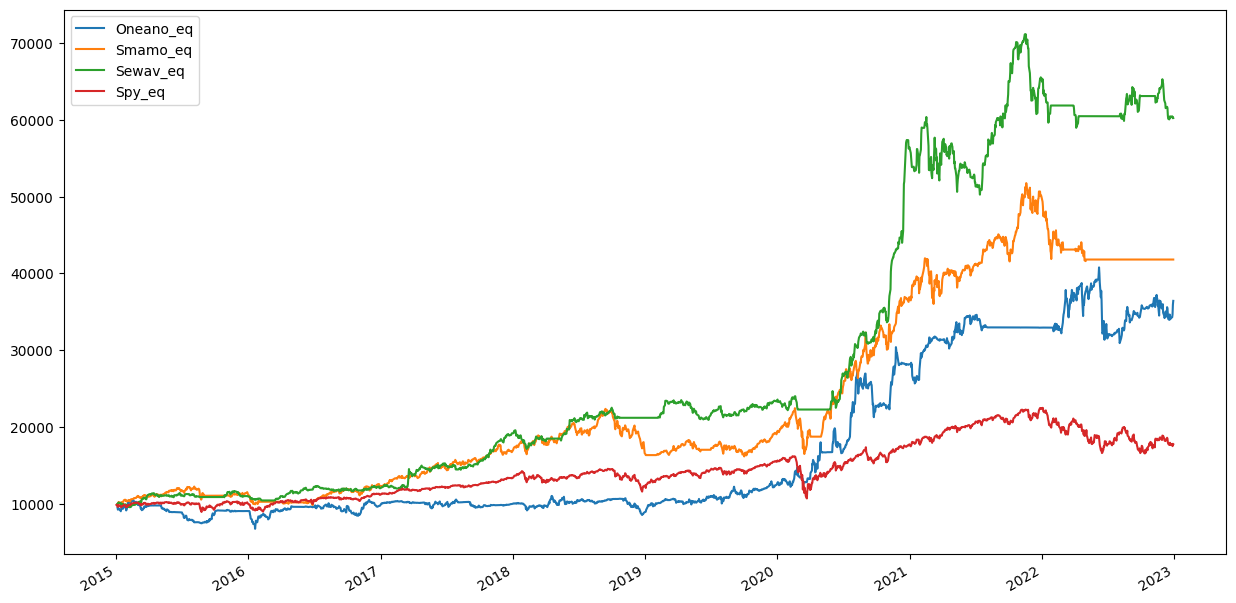

We invite you to delve into the intricacies of three carefully constructed systematic strategies. The ‘Smart Nasdaq Momentum’ navigates through a rotational momentum strategy by trading stocks from the esteemed Nasdaq 100. The ‘Second Wave’ employs a momentum pullback strategy, dealing with stocks from the vast Russell 3000 index. Finally, the ‘One and Only’ utilizes a momentum rotational strategy, trading a universe of uncorrelated ETFs. Learn how these strategies can enrich your financial portfolio and provide a competitive edge in the marketplace.

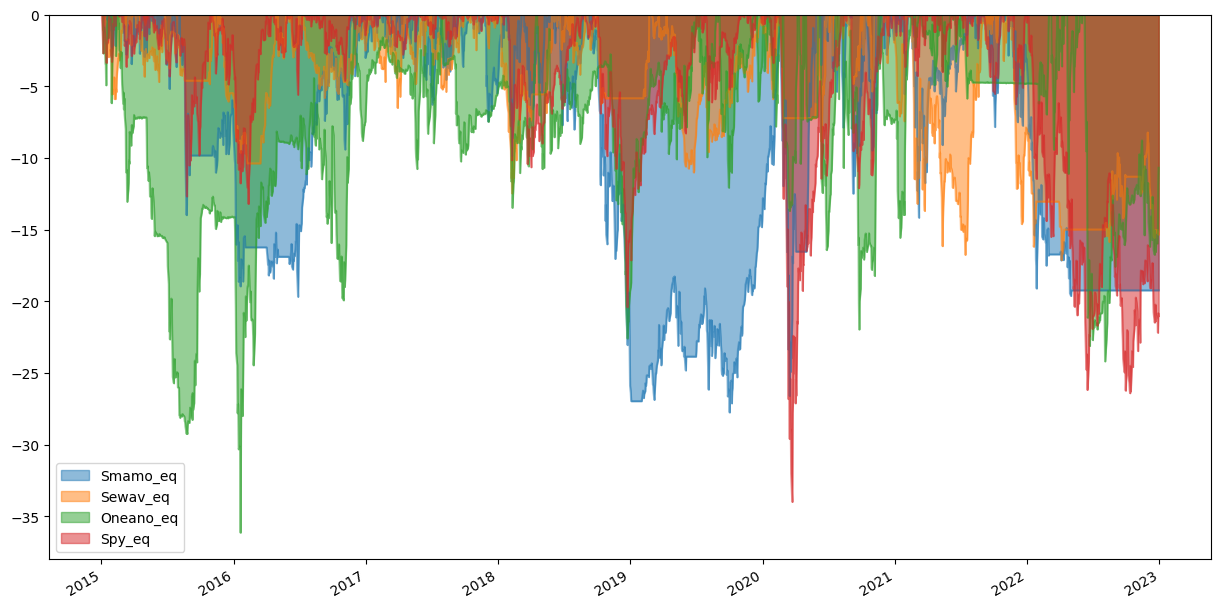

The workshop offers comprehensive statistics for each strategy, providing you with a robust understanding of their performance patterns. You will gain insights into when these strategies flourish and when they experience significant drawdowns. Such knowledge is instrumental in fostering confidence in these trading systems.

These strategies operate on extended timeframes – ‘Smart Nasdaq’ and ‘One and Only’ function on a monthly basis, while ‘Second Wave’ works on a daily timeframe. Therefore, it is entirely feasible to operate these strategies without complete automation. You can simply arrange scanners included in workshop to produce entry signals and manually generate orders on the broker’s platform. This approach can be particularly advantageous for beginners, simplifying the commencement of portfolio trading.